EUR/USD remains under pressure around 1.1600

- EUR/USD fades the initial uptick to the 1.1615 area.

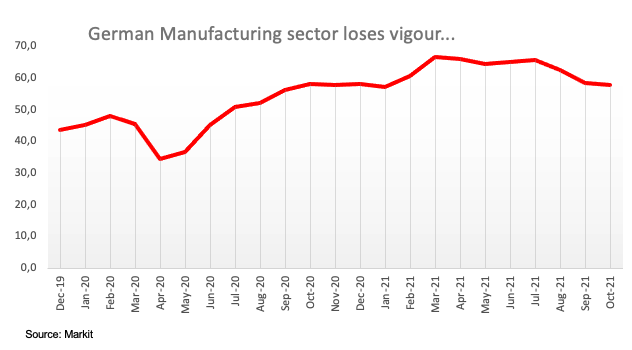

- German, EMU final Manufacturing PMI recedes further.

- German 1oy Bund yields reverse the recent uptrend.

After an ephemeral move to levels past the 1.1600 barrier, EUR/USD has now returned to the 1.1590 region amidst the generalized lack of clear direction in the global markets.

EUR/USD now focuses on the FOMC

EUR/USD resumes the downside following Monday’s bullish attempt against the backdrop of the generalized absence of clear direction in the global markets along with a mild improvement in the greenback.

Indeed, markets seem to have entered the usual pre-FOMC lull as the Federal Reserve’s 2-day meeting kicks in later today. On the latter, consensus among market participants remains tilted to the announcement of the start of the QE tapering this month, at a likely $15B monthly pace.

In the docket, final Manufacturing PMIs in both Germany and the broader Euroland came in a tad below the preliminary figures, which is also seems to be weighing on the shared currency on turnaround Tuesday.

A thin US docket includes the November’s IBD/TIPP Economic Optimism Index seconded by the API’s weekly report on US crude oil inventories.

What to look for around EUR

EUR/USD plummeted well below the 1.1600 support on Friday, although it managed to regain some composure at the beginning of the week. In the meantime, spot continues to look to the risk appetite trends for direction as well as dollar dynamics, while the loss of momentum in the economic recovery in the region - as per some weakness observed in key fundamentals - is also seen pouring cold water over investors’ optimism and tempering bullish attempts in the European currency. Further out, the single currency should remain under scrutiny amidst the implicit debate between investors’ expectations of a probable lift-off sooner than anticipated and the ECB’s so far steady hand, all amidst the persevering elevated inflation in the region and prospects that it could extend further than previously estimated.

Key events in the euro area this week: Final Manufacturing PMIs (Tuesday) – ECB’s Lagarde, EMU Unemployment Rate (Wednesday) - Final Services PMIs (Thursday) – EMU Retail Sales (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the region. Sustainability of the pick-up in inflation figures. Pick-up in the political effervescence around the EU Recovery Fund in light of the rising conflict between the EU, Poland and Hungary on the rule of law. ECB tapering speculations.

EUR/USD levels to watch

So far, spot is losing 0.12% at 1.1591 and faces the next up barrier at 1.1691 (55-day SMA) followed by 1.1692 (monthly high Oct.28) and finally 1.1755 (weekly high Sep.22). On the other hand, a break below 1.1535 (weekly low Oct.29) would target 1.1524 (2021 low Oct.12) en route to 1.1495 (monthly low Mar.9 2020).