Back

14 Jun 2021

Gold Futures: Further losses not favoured

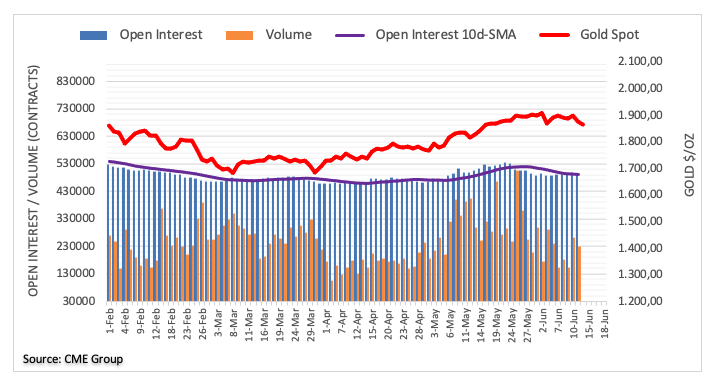

Open interest in gold futures markets shrank by nearly 3.1K contracts on Friday according to flash data from CME Group. In the same direction, volume extended the choppy activity and dropped by around 32.6K contracts.

Gold faces support near $1,850

Another rejection from the $1,900 area sparked a moderate selloff in gold prices at the end of last week. The move, however, was on the back of shrinking open interest and volume, indicative that a deeper pullback is not favoured in the very near term. That said, the so far monthly lows around $1,855 per ounce troy (June 4) and the 200-day SMA ($1,851) emerge as a decent contention for the time being.