USD/CHF Price Analysis: Looks to extend gains towards 0.9200

- USD/CHF remains on the track to post small daily gains on Wednesday.

- Bears challenge the key support area around the 0.9150 region.

- Neutral MACD favours upside momentum.

The USD/CHF pair losses part of its daily gains in the European session. The pair peaked at 0.9183 before it touched the intraday low of 0.9152 and accumulated a move of around 40 pips from the daily lows earlier in the day.

At the time of writing, USD/CHF is trading at 0.9154, up 0.23% on the day.

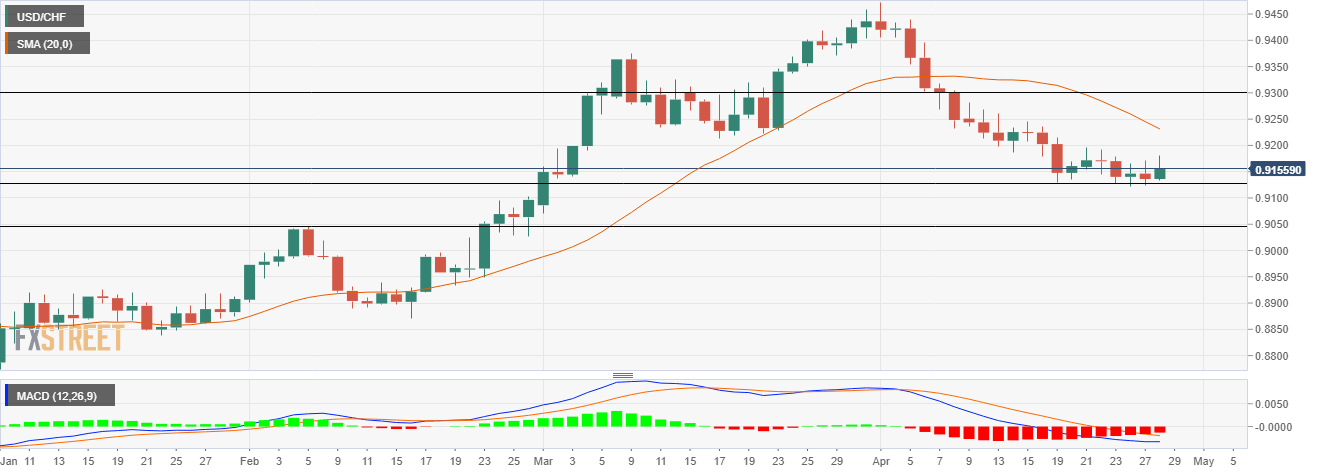

USD/CHF daily chart

On the daily chart, the pair has been accumulating gains near the 0.9135-0.9155 neighbourhood. After falling from the monthly highs near the 0.9475 zone, the pair is now consolidating around the 0.9150 region. The formation of the candlesticks pattern suggests that the bears are now a bit cautious before placing any aggressive directional bets.

The Moving Average Convergence Divergence(MACD) indicator reads below the midline, however, USD/CHF bulls should wait for some confirmation before jumping into the long side of the trade. Moving higher, the first resistance will be Thursday’s high of 0.9191 and afterwards, the next stoppage would be the highs made on April 19 near the 0.9215 region. Bulls would flex their muscle towards the 20-day SMA placed at 0.9230 on the northern side.

On the flip side, if the price breaks below 0.9130 and makes a sustained move below the mentioned level, then it would open the gates for 0.9120 and 0.9090 - horizontal support zones. The next on bears’ radar will be the lows of March 1 near the 0.9070 region.

USD/CHF additional levels