Silver Price Analysis: XAG/USD rallies hard to eight-year highs at $30, more gains in the offing

- XAG/USD tested the $30 mark for the first time in eight years.

- Bulls remain in control amid the retail-trade frenzy.

- $32.25 next in sight for buyers amid bullish monthly RSI.

Silver (XAG/USD) bulls remain unstoppable for the fourth straight trading session this Monday, as the price reached the highest levels since February 2013 at $30.06.

The relentless rise in silver is mainly driven by the Reddit Group’s led retail-trader craze, who have now shifted their attention to silver while targeting the white metal at $1000/ ounce.

Meanwhile, SD Bullion cited that the physical stock of silver is almost gone, further fuelling the rally in the precious metal.

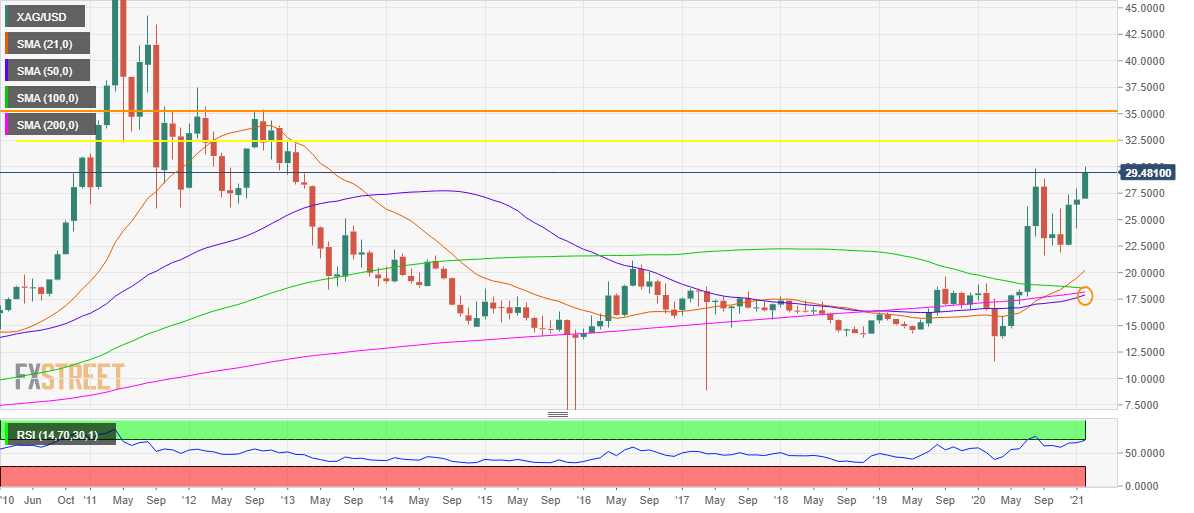

From a technical perspective, the outlook appears bullish for the XAG bulls, with the next upside target placed at the horizontal trendline resistance (yellow) at $32.25 should the buyers gain a strong foothold above the $30 mark.

Silver Price Chart: Monthly

Further north, the horizontal trendline resistance located at $35.23 could challenge the bulls’ commitment.

The Relative Strength Index (RSI) hold firmer above 50.00, now peeping into the overbought territory, suggesting that there is a scope for further upside.

Meanwhile, a 21-simple moving average (SMA) and 100-SMA bullish crossover on the said timeframe, which occurred a few months ago, adds credence to the move higher.

Further, a potential golden cross also keeps the doors open for more gains.

Silver Additional levels