S&P 500 Index opens in red, financial stocks rise on surging T-bond yields

- Major equity indexes in the US started the day in the negative territory.

- Financial stocks post strong gains on the back of rising Treasury bond yields.

Wall Street's main indexes opened lower on Wednesday as investors wait for the official result of the runoff election in Georgia, which suggests that Democrats are likely to take control of the Senate. As of writing, the Dow Jones Industrial Average was down 0.1% on the day at 30,371, the S&P 500 was losing 0.44% at 3,710 and the Nasdaq Composite was slumping 1.15% at 12,669.

Meanwhile, heightened hopes for additional government spending with a Democratic majority in the Senate is providing a boost to the US Treasury bond yields. With the benchmark 10-year reference gaining more than 6% on Wednesday, the rate-sensitive S&P 500 Financials Index is rising 2.4% as the best performing major sector.

On the other hand, the Technology Index and the Communication Services Index both lose more than 1% after the opening bell.

Earlier in the day, the data published by the Automatic Data Processing (ADP) Research Institue showed that employment in the US' private sector declined by 123,000 in December. This reading missed the market expectation of +88,000 by a wide margin and weighed on market sentiment.

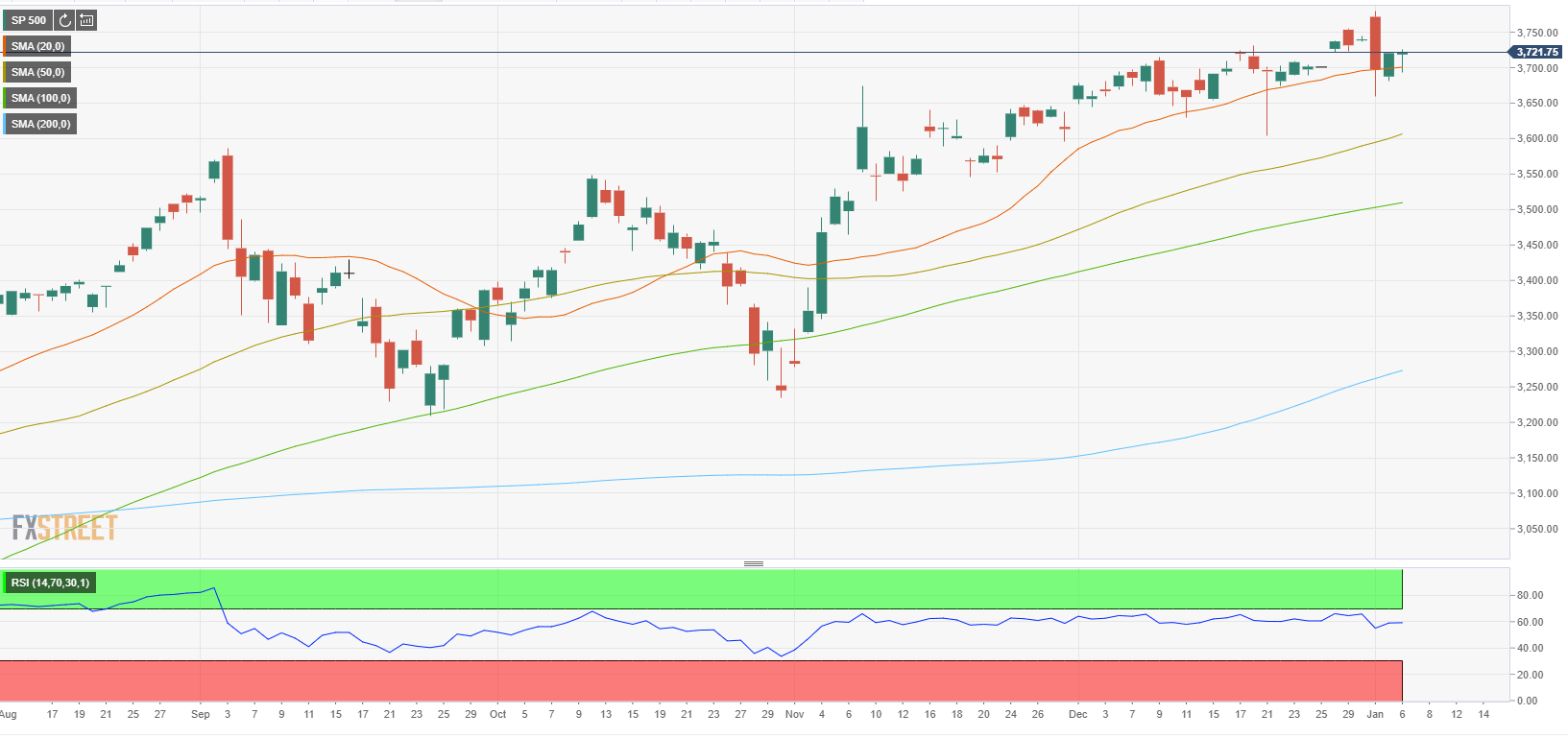

S&P 500 chart (daily)