Gold Price Analysis: XAU/USD faces two hurdles amid new covid strain – Confluence Detector

Gold has fallen off the highs as panic over the new covid strain boosted the safe-haven dollar – weakening everything else. Earlier, the precious metal advanced after Republicans and Democrats announced an agreement on a stimulus deal.

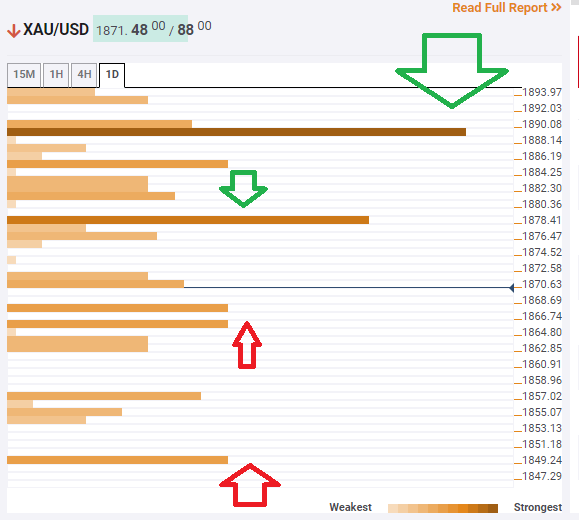

How is XAU/USD after the whipsaw on the charts?

The Technical Confluences Indicator is showing that gold faces resistance at $1,878, which is the convergence of the previous daily low and the Fibonacci 23.6% one-week.

A considerable cap awaits at $1,889, which is the meeting point of the Pivot Point one-day Resistance 1 and the Fibonacci 61.8% one-month.

Some support is at $1,867, which is where the Fibonacci 8.2% one-week and the PP one-day Support 3 hit the price.

Further down, another cushion is at $1,849, which is where the Fibonacci 61.8% one-week hits the price.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence