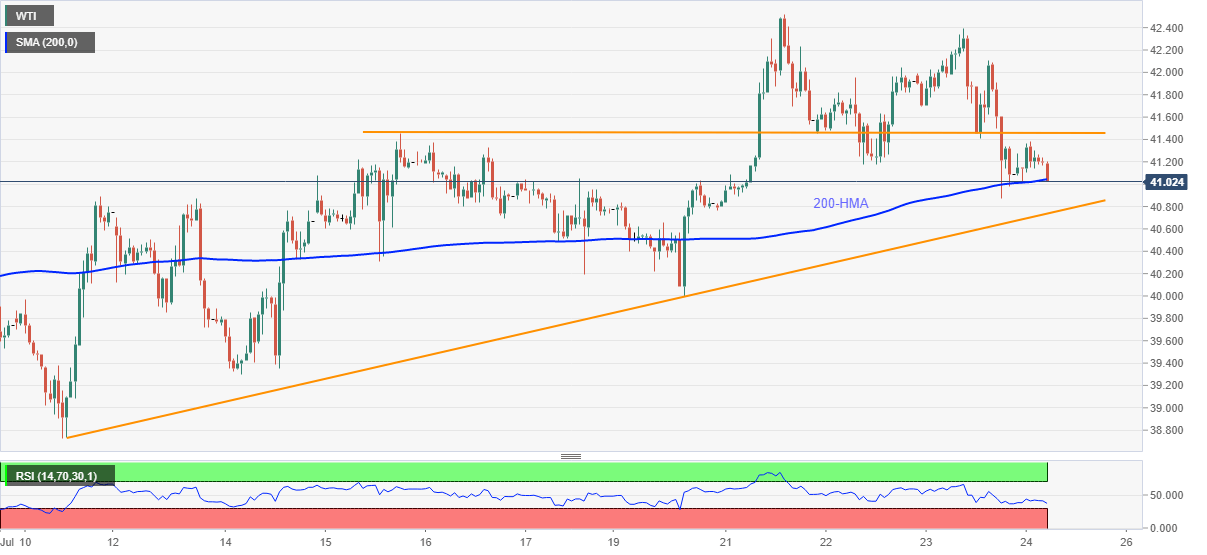

WTI Price Analysis: 200-HMA regains bears’ attention amid broad risk-off

- WTI recedes from $41.38 following its pullback from 200-HMA.

- China retaliates to the US order on Houston Consulate, Asian equities bleed red.

- An ascending trend line from July 10 adds to the downside support.

- $41.45 offers near-term key resistance before the monthly top.

WTI defies early-Asia gains while declining to $41.05 down 0.10% on a day, as the European traders prepare for ringing the bell on Friday. The black gold’s multiple failures to stay positive beyond a horizontal trend line from July 15 portrays the quote’s weakness whereas the recent risk-off adds to the commodity’s weakness.

Read: Asian stock market: A sea of red as China retaliates US order on Houston

However, the US dollar’s downbeat performance and 200-HMA questions the bears around $41.00 threshold. Should the bears manage to stay dominant past-$41.00, a two-week-old support line, at $40.70 now, will be the key to $40.00 round-figure.

Assuming the sellers' ability to conquer $40.00, calls of fresh monthly low under $38.73 can’t be ruled out.

Alternatively, a clear upside past-$41.45 will have $41.80 and $42.40 acting as the buffers before the monthly top close to $42.52.

Though, a daily close past-$42.52 will be the signals for bulls to target February month low near $44.00.

WTI hourly chart

Trend: Pullback expected