Back

21 Jul 2020

Crude Oil Futures: Further rangebound on the cards

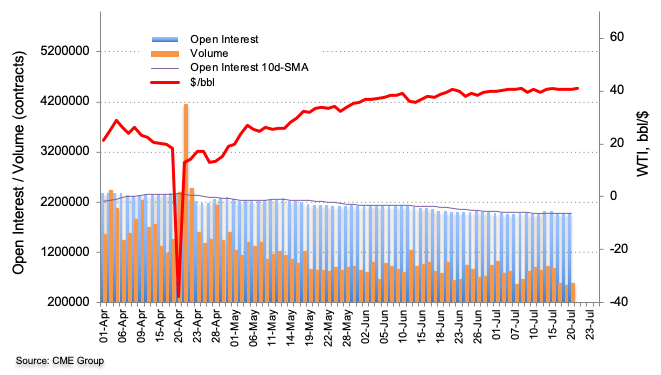

In light of preliminary figures from CME Group, traders scaled back their open interest positions for the fourth session in a row on Monday, now by almost 5.3K contracts. Volume, instead, reversed three straight pullbacks and advanced by nearly 40K contracts.

WTI still capped by the 200-day SMA

Prices of the barrel of WTI are extending the consolidative mood around the $40.00/$41.00 mark. Inconclusive performance of both open interest and volume is seen keeping the side-lined theme unaltered for the time being. In addition, the key 200-day SMA at $43.45 continues to cap occasional bullish attempts.