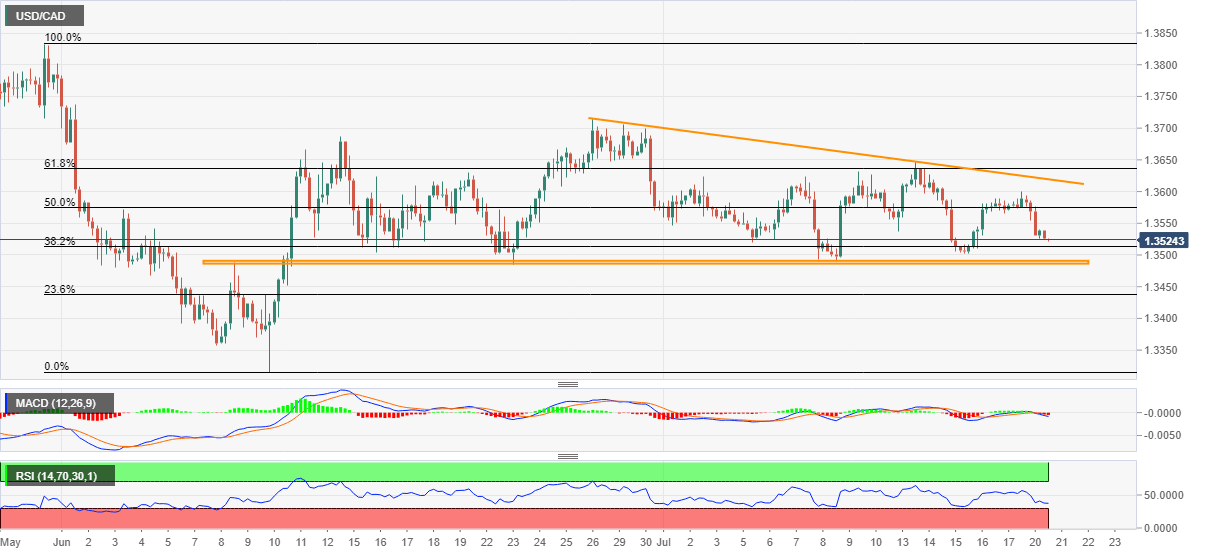

USD/CAD Price Analysis: Offered above 1.3500, six-week-old horizontal support in focus

- USD/CAD extends the previous day’s losses from 1.3539.

- A three-week-old resistance line restricts the pair’s immediate upside.

- Multiple levels since early-June offer strong support near 1.3490-85 area.

- Bearish MACD suggests a further weakness but RSI signals bounce off the immediate support.

USD/CAD drops to 1.3525 as markets in Tokyo open for trading on Tuesday. In doing so, the loonie remain remains weak for the second day in a row. With the bearish MACD signals the quote’s further weakness, a multi-day-old horizontal support pop-up on the sellers’ radars.

Should lingering RSI conditions fail to limit the pair’s downside around 1.3490/85 support-zone, 23.6% Fibonacci retracement of May 29 to June 10 downside, around 1.3435 might challenge additional weakness.

In a case where the USD/CAD prices continue to decline past-1.3435, 1.3360 and June month’s low near 1.3315 could gain market attention.

Alternatively, 1.3565 and 1.3600 may entertain the buyers during the quote’s U-turn. Though, the bearish view gets a hit if the bulls manage to take out 1.3620 mark comprising a falling trend line from June 26.

Following that, the quote becomes capable of attacking the monthly top surrounding 1.3650 with the previous month’s peak near 1.3715 be next in the line.

USD/CAD four-hour chart

Trend: Bearish