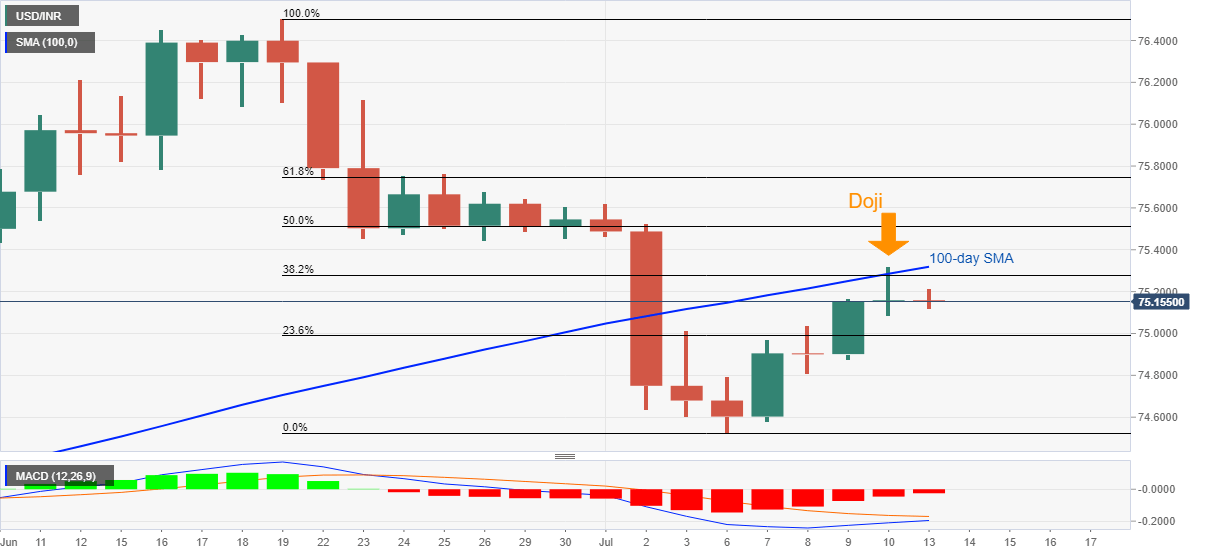

USD/INR Price News: Indian rupee bulls justify Friday’s bearish Doji to attack 75.00

- USD/INR takes U-turn from 75.22 after the previous day’s bearish candlestick formation.

- Bearish MACD also favors the sellers targeting a sub-75.00 area.

- 100-day SMA, 50% Fibonacci retracement limit short-term immediate upside.

USD/INR snaps the two-day winning streak while declining to 75.12 during the pre-European session on Monday. The quote follows the bearish candlestick pattern to extend the U-turn from 100-day SMA. Also increasing the odds of the pair’s further weakness could be the bearish MACD signals.

As a result, the 75.00 threshold is again under attack ahead of 74.80 level comprising July 06 high and Wednesday’s low.

However, the quote’s failure to bounce off 74.80 might not refrain from challenging the late-March lows near 74.40.

On the flip side, a clear break above the 100-day SMA level of 75.32 will trigger a fresh rise of the pair towards 50% Fibonacci retracement of June 19 to July 07 fall, around 75.50.

In a case where the bulls remain dominant past-75.50, 61.8% Fibonacci retracement level close to 75.75 and 76.00 round-figures will return to the charts.

USD/INR daily chart

Trend: Further weakness expected