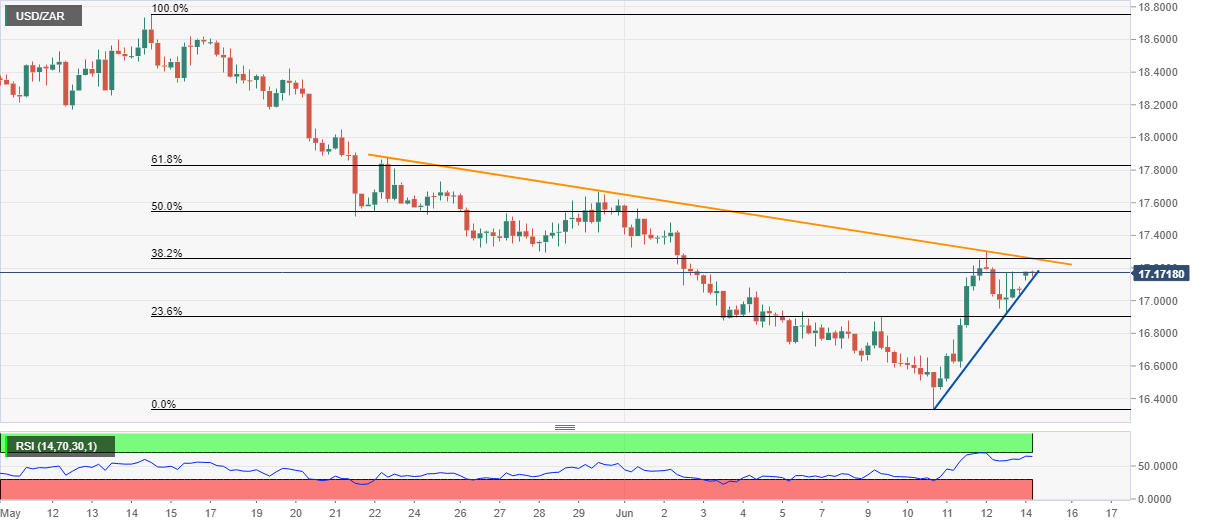

USD/ZAR Price Analysis: Eyes three-week-old resistance line on recovery beyond 17.00

- USD/ZAR extends recovery moves from 16.93.

- A three-day-old rising trend line favors the short-term buyers towards refreshing the monthly top.

- Sellers will have multiple downside supports below 17.00.

USD/ZAR remains on the front foot while taking the bids near 17.17 during Monday’s Asian session. The pair extends the recovery moves from Wednesday and heads to a downward sloping trend line from May 22 by the press time.

Though, RSI conditions and 38.2% Fibonacci retracement of the pair’s fall from May 14 to June 10 make the 17.25 resistance confluence the key for the bulls.

In a case where the USD/ZAR prices rise beyond 17.25, the monthly high of $17.30 can easily be overlooked, which in turn can propel the quote towards May 29 top surrounding 17.67. During the pair’s further upside past-17.67, the 61.8% Fibonacci retracement level of 17.83 could lure the buyers.

Meanwhile, a downside break of the immediate support line, currently around 17.10, could drag the quote to 17.00 round-figures.

However, 23.6% Fibonacci retracement level of 16.90 and 16.65 might challenge the bears below 17.00 ahead of diverting them to the monthly low of 16.34.

USD/ZAR four-hour chart

Trend: Further recovery expected