Back

11 Jun 2020

Crude Oil Futures: Extra gains look unlikely

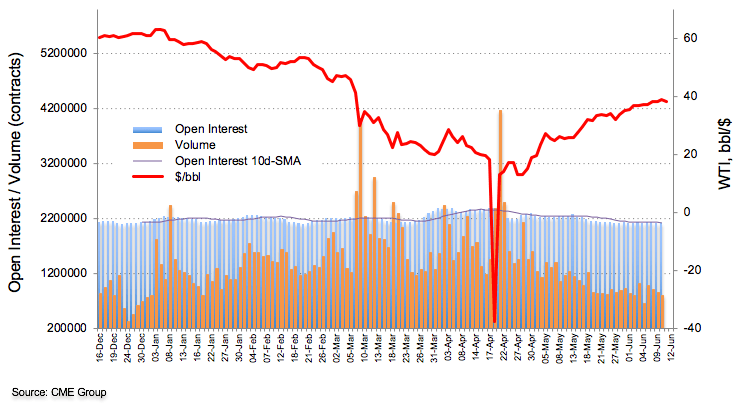

In light of advanced readings from CME Group for crude oil futures markets, traders trimmed their open interest positions for the second session in a row on Wednesday, this time by nearly 2.4K contracts. In the same line, volume went down by around 52.6K contracts.

WTI remains capped by $40.00

Prices of the barrel of WTI failed once again to surpass the key $40.00 barrier on Wednesday amidst shrinking open interest and volume. That said, and with the $40.00 mark still a tough nut to crack for oil bulls, the door appears open to a correction lower in the short-term horizon.