AUD/JPY Price Analysis: Recovers from three-day low, but still under 100-day EMA

- AUD/JPY benefits from upbeat prints of Australia’s May month Westpac Consumer Confidence.

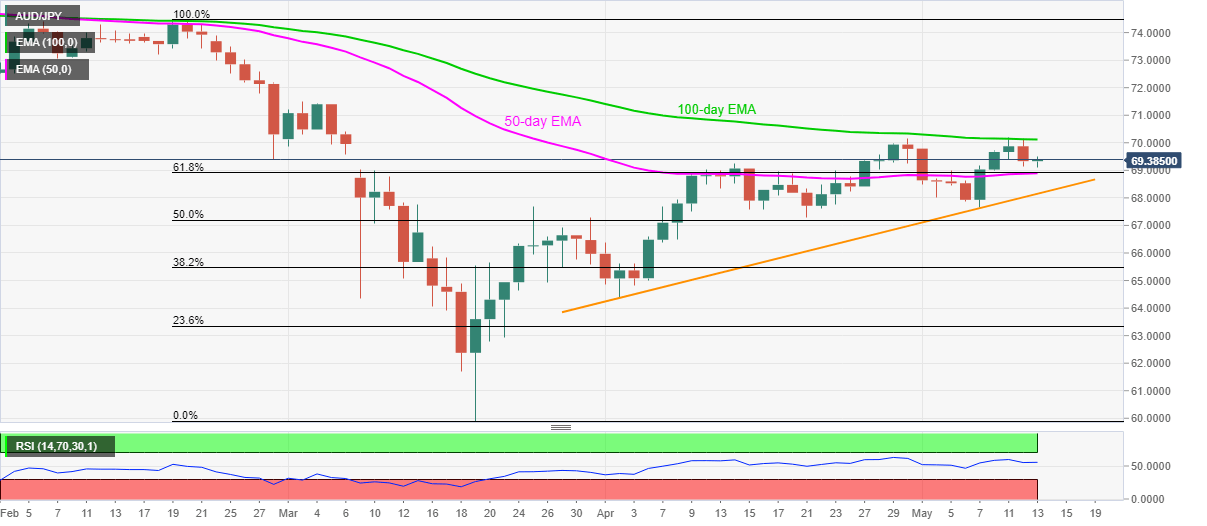

- A confluence of 50-day EMA and 61.8% Fibonacci retracement offers immediate strong support.

- A six-week-old rising trend line adds to the support.

AUD/JPYextends recovery moves from 69.10 to 69.33 after Aussie consumer sentiment data pleased buyers during Wednesday’s Asian session. Even so, the pair stays below 100-day EMA.

Australia’s Westpac Consumer Confidence for May gains 16.6% versus -17.7 prior.

Even so, the pair’s recent pullback from the key EMA keeps sellers hopeful while targeting a confluence of 50-day EMA and 61.8% Fibonacci retracement of February-March fall, near 68.90/85.

Should the pair drops further below 68.85, an upward sloping trend line from April 02, currently near 68.15, will be the key to watch as a break of which can refresh monthly low under 67.60.

On the contrary, a daily closing beyond 100-day EMA level of 70.11 won’t be sufficient for the pair to aim for March month high of 71.52 as April peak near 70.20 will validate further upside.

AUD/JPY daily chart

Trend: Pullback expected