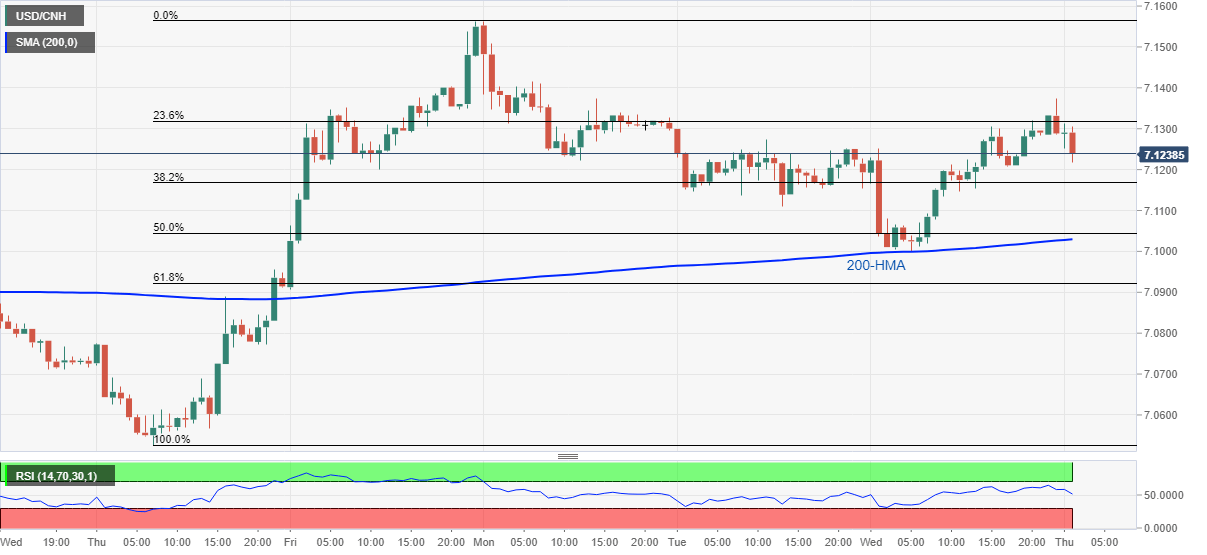

USD/CNH Price Analysis: Ignores China Caixin Services PMI, eyes on trade data

- USD/CNH extends pullback from the early-week top,

- 200-HMA, 61.8% Fibonacci retracement seems to lure the bears.

- Buyers will have March top on radars beyond 7.1563.

USD/CNH drops to 7.1222, down 0.10% on a day, despite China’s downbeat Caixin Services PMI amid early Thursday.

Read: China's Caixin services PMI rises to 44.4 in April, a big miss – Aussie unfazed

That said, the pair extends reversal from the early-week top towards the key 200-HMA level of 7.10000, a break of which could rest 61.8% Fibonacci retracement of April 30 to May 04 rise, around 7.0920.

During the quote’s further downside past-7.0920, 7.0770 and last-Thursday low near 7.0520 may return to the charts.

Alternatively, an upside clearance of 7.1375 can challenge the current month high near 7.1563.

Though, a sustained break above 7.1563 should propel the upside momentum towards March month high surrounding 7.1650.

Looking forward, China's April month trade data will be the key for near-term direction.

USD/CNH hourly chart

Trend: Further pullback expected