Back

30 Mar 2020

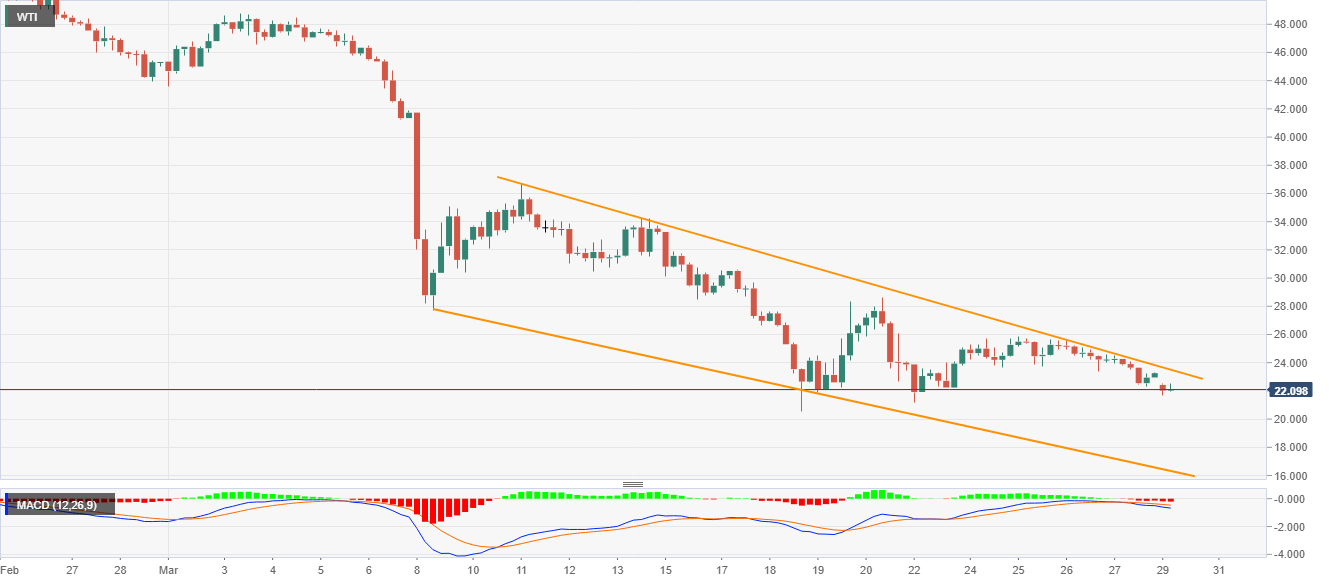

WTI Price Analysis: Bears dominate below 13-day-old resistance trendline

- WTI remains on the back foot below the short-term falling resistance line.

- $20.00 becomes the key for sellers ahead of targeting the three-week-old descending trend line.

While following a short-term falling trend line resistance, WTI drops to $22.000 amid the early Monday. In doing so, the energy benchmark remains near multi-year low amid the bearish MACD.

That said, oil prices are currently declining towards $20.00 round-figure ahead of taking rest on the downward sloping trend line since March 09, at $16.32.

Alternatively, an upside clearance of the immediate resistance line, at $23.50 now, can aim for $28.60 and $30.00 during the further advances.

However, the bulls are less likely to be convinced unless providing a clear run-up beyond March 11 top surrounding $36.65/70.

WTI four-hour chart

Trend: Bearish