Back

9 Mar 2020

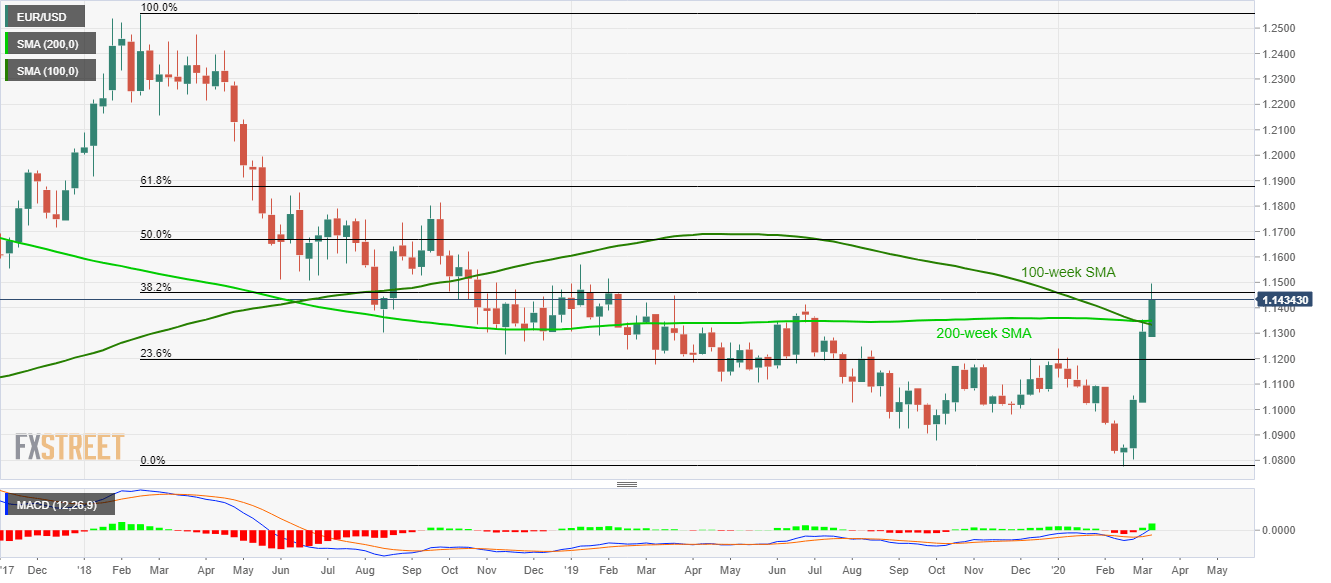

EUR/USD Price Analysis: Refreshes one-year high to near 1.1500, above 100/200-week SMA

- EUR/USD remains on the front foot at the multi-week top.

- The year 2019 high offers immediate resistance ahead of 50% Fibonacci retracement.

- Sellers can target January top on the downside break below 100/200-day SMA.

EUR/USD isn’t behind the majors amid the present ex-USD moves that have been taking clues from coronavirus (COVID-19). The pair recently surged to the highest since February 2019 to 1.1497, currently up 1.27% around 1.1450, during Monday’s Asian session.

With the sustained break above 100 and 200-week SMA confluence, EUR/USD is all gearing up to challenge the year 2019 top surrounding 1.1570.

However, the pair’s further upside could be questioned by 50% Fibonacci retracement of its broad declines from February 2016 to February 2020, near 1.1670.

On the contrary, the pair’s declines below the said SMA confluence close to 1.1350/33 can recall January month high of 1.1239 back to the charts.

EUR/USD weekly chart

Trend: Bullish