Back

5 Nov 2019

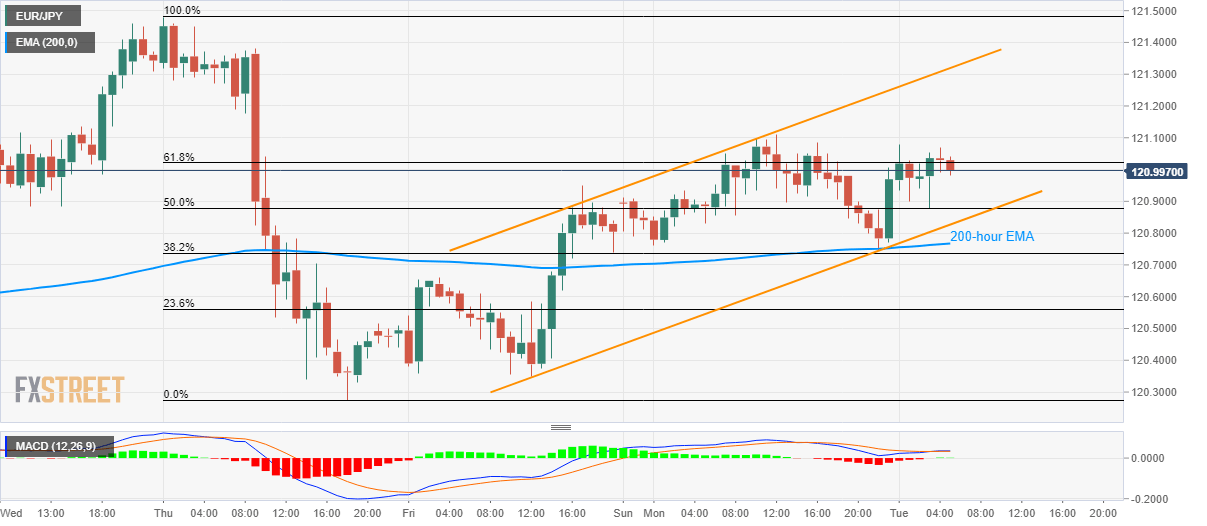

EUR/JPY technical analysis: Positive above 200-hour EMA, inside a rising channel

- EUR/JPY clings to 61.8% Fibonacci retracement of October-end declines.

- A downside break of 200-hour EMA will defy short-term bullish bias.

Although EUR/JPY trades in a range around 61.8% Fibonacci retracement, it keeps the overall bullish bias intact while taking rounds to 121.00 during pre-European session open on Tuesday.

The pair stays above 200-hour Exponential Moving Average (EMA) while also portraying a two-day-old rising channel on the hourly chart. Also supporting the upside is bullish signals from 12-bar Moving Average Convergence and Divergence (MACD).

With this, pair’s run-up to channel resistance, at 121.32, and the following increase to 121.50 seem quite acceptable.

However, a downside break below 200-hour EMA level of 120.77 could recall October-end low surrounding 120.28 and could also push sellers toward 120.00 round-figure during further declines.

EUR/JPY hourly chart

Trend: bullish