Back

30 Oct 2019

EUR/USD technical analysis: Euro challenging daily lows ahead of Fed’s press conference

- The Euro is trading at daily lows as the Fed cut interest rates as expected.

- The Fed’s press conference is crucial as it will give clues as to whether new rate cuts are coming or not.

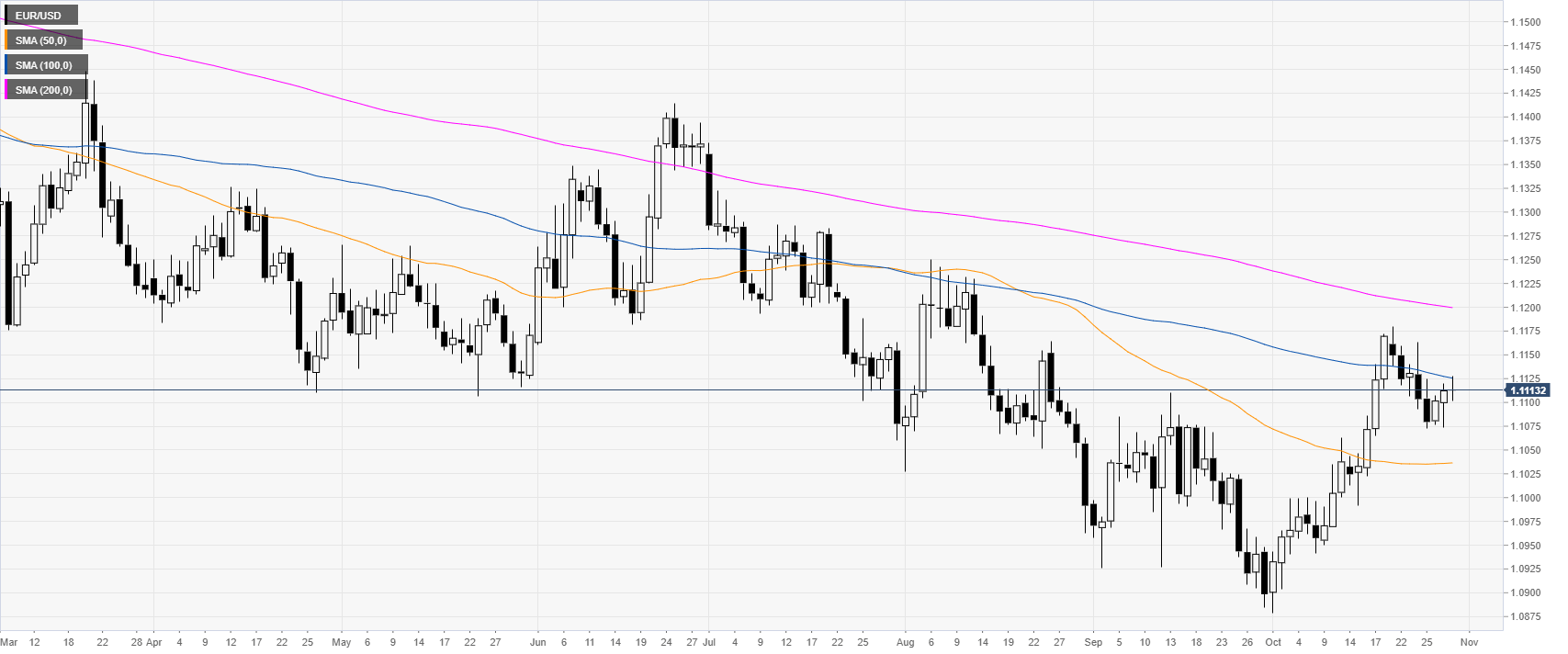

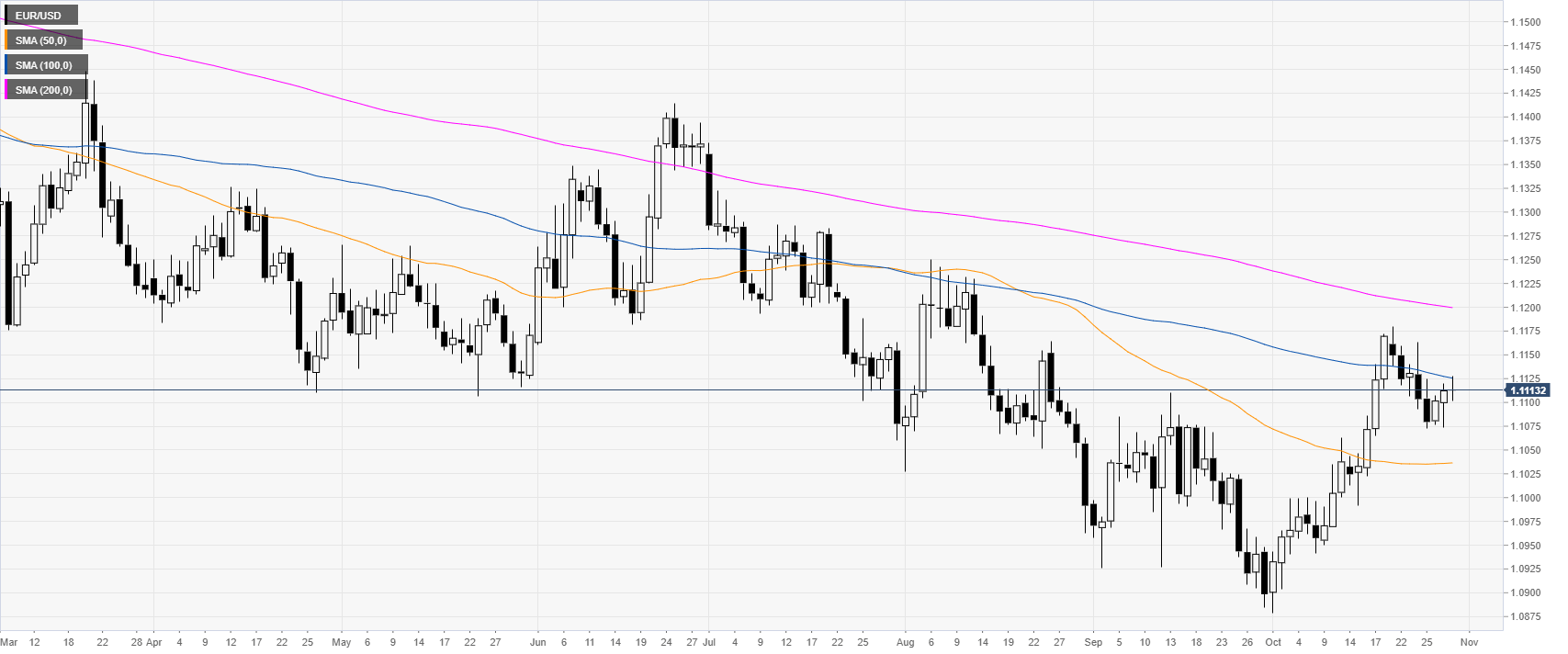

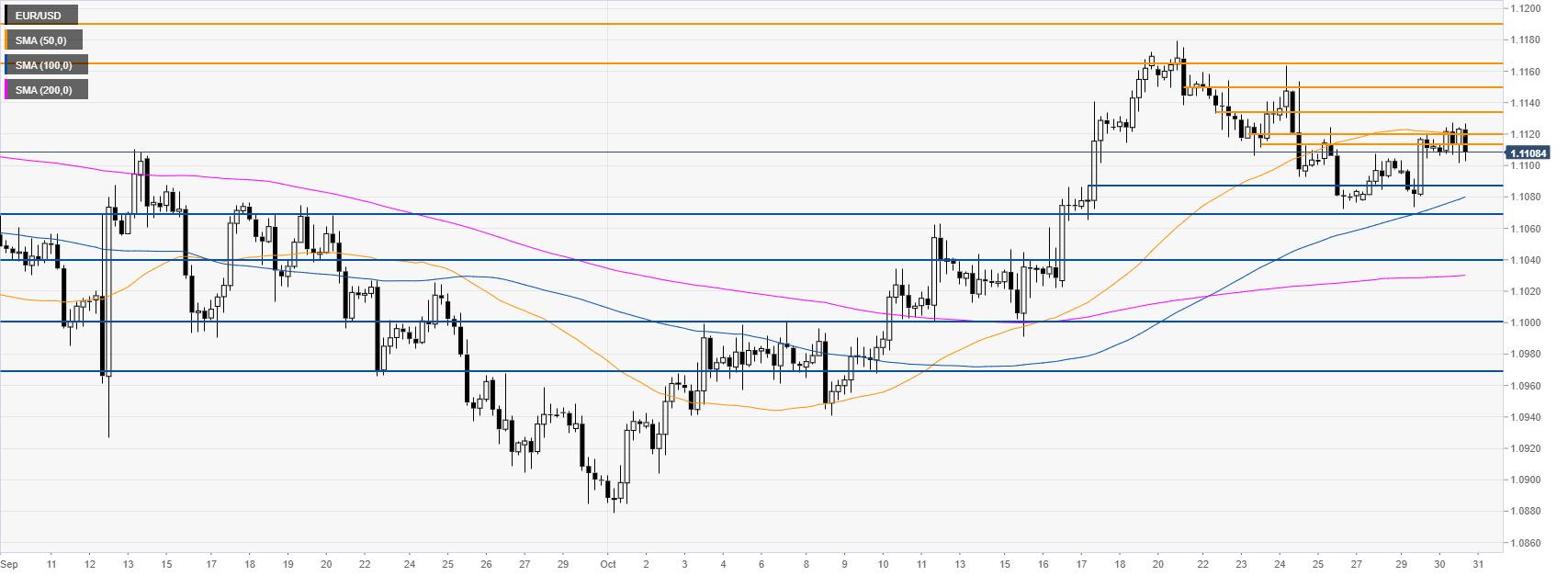

EUR/USD daily chart

On the daily chart, the Euro is trading in a bear trend below its 100 and 200-day simple moving averages (DMAs). The Fed cut interest rates by 25 bps as widely expected. The market is now going to focus on the press conference to find out if further rate cuts are on the horizon.

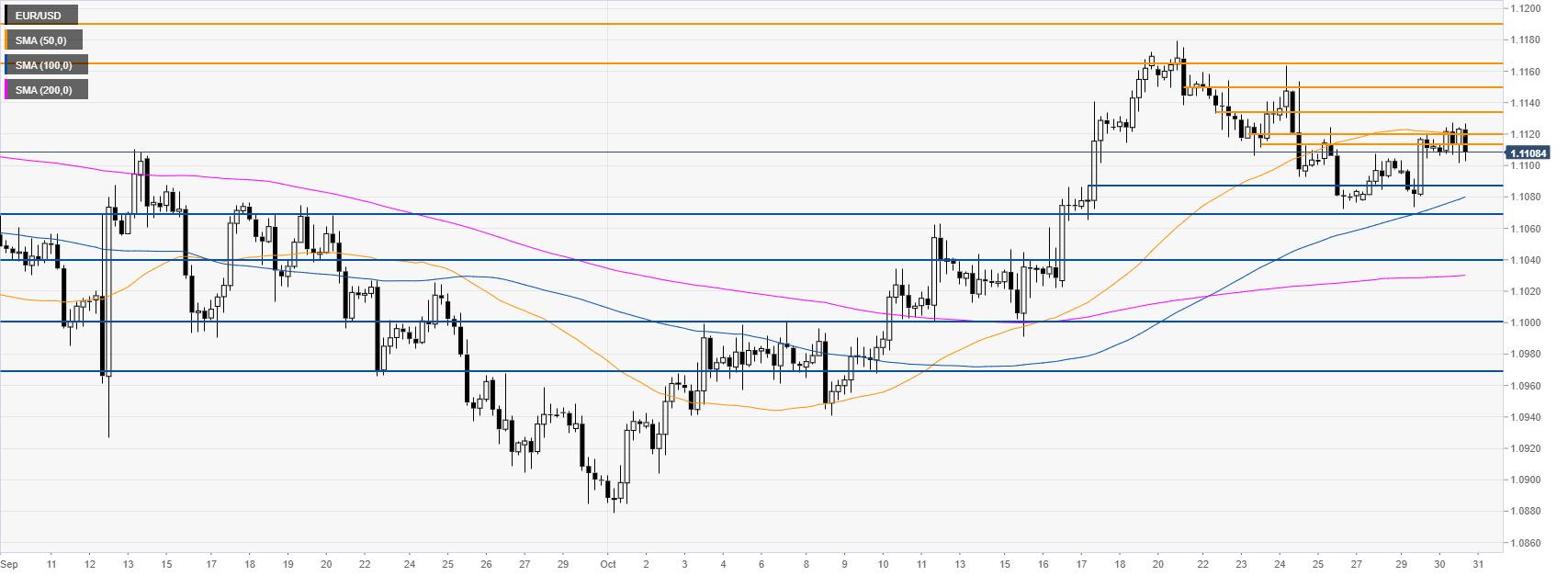

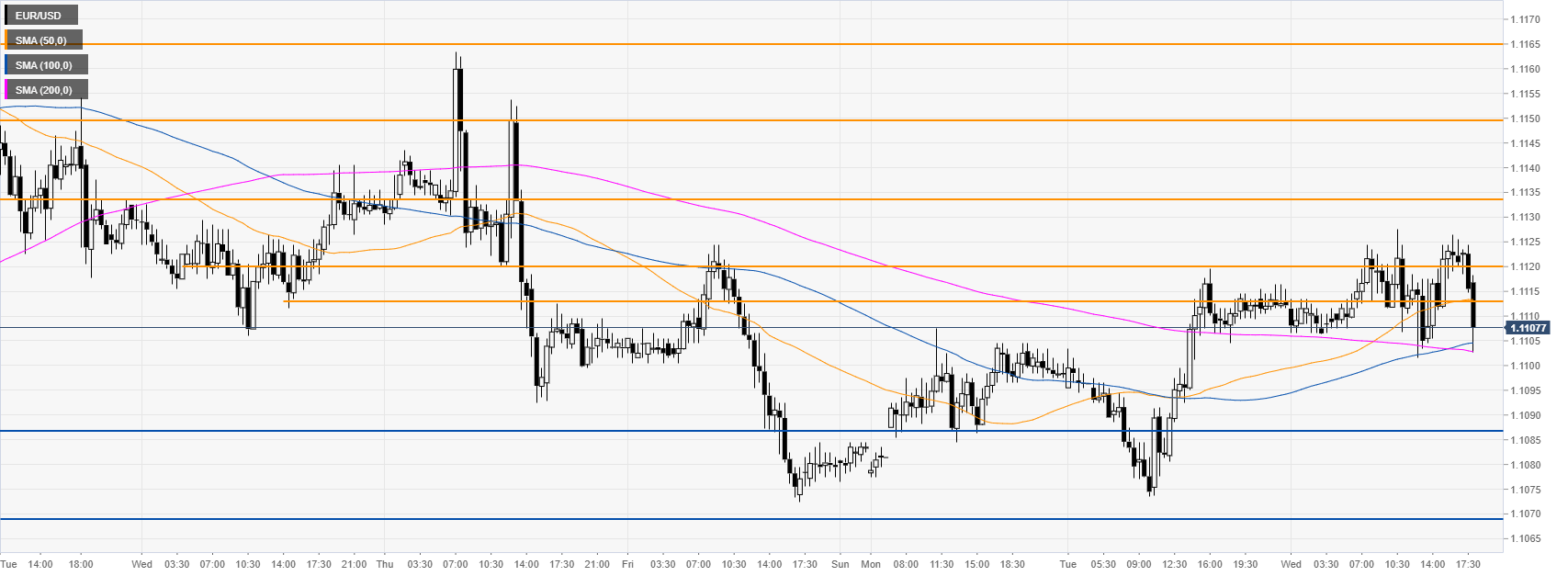

EUR/USD four-hour chart

The Fiber, on the four-hour chart, is trading above the 100 and 200 SMAs. The market is trading off daily highs below the 1.1113/20 resistance zone and the 50 SMA. The level to beat for buyers would be the 1.1133 resistance. A break above it can lead the spot to 1.1150, 1.1165 and 1.1191, according to the Technical Confluences Indicator. However, this scenario would likely be in play this Wednesday if Fed’s Chair Powell proved to be dovish in the press conference.

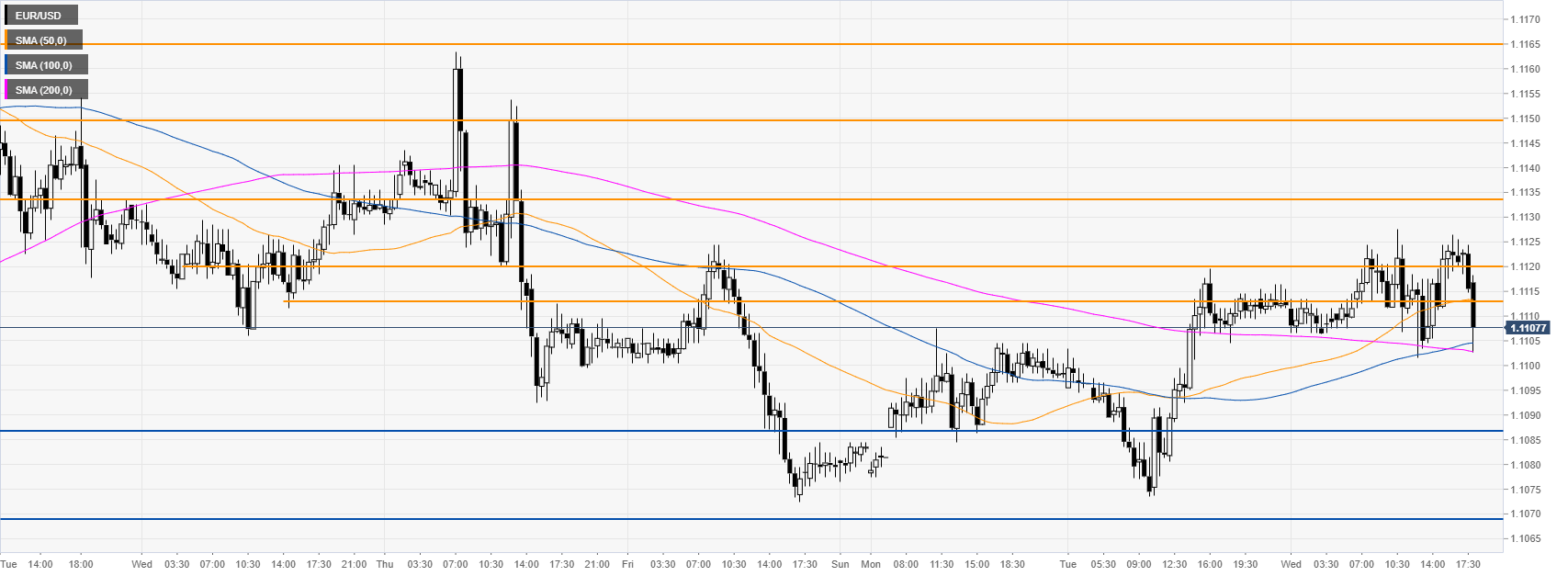

EUR/USD 30-minute chart

The EUR/USD is trading between the 500 and 200 SMAs on the 30-minute chart, suggesting a sideways bias in the near term. Support is seen at the 1.1088, 1.1070 and 1.1040 price levels.

Additional key levels