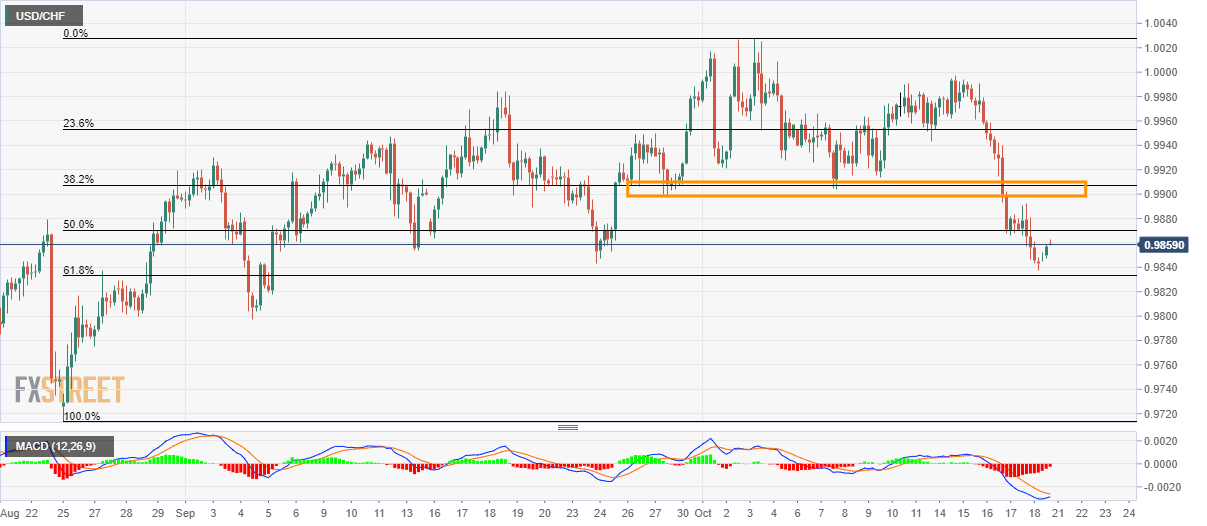

USD/CHF technical analysis: 0.9900/10 challenges recovery from 61.8% Fibo.

USD/CHF bounces off from a multi-week low.

38.2% Fibonacci retracement, late-September bottoms can question the recent upside.

The USD/CHF pair’s latest recovery is less likely to prevail for long unless clearing near-term key resistance area. The quote seesaws around 0.9860 by the press time of the pre-European session on Monday.

While 50% Fibonacci retracement of late-August to the early-October upside, at 0.9870, can act as an immediate upside barrier, 0.9900/10 supply-zone comprising late-September lows and 38.2% Fibonacci retracement will become a tough nut to crack for buyers.

On the break of 0.9910, 0.9960 and 1.0000 will regain market attention.

Alternatively, pair’s declines below 61.8% Fibonacci retracement near 0.9830 will fetch prices to September month low nearing 0.9800 whereas 0.9770 and late-August bottom nearing 0.9715 could flash on bears’ radar afterward.

USD/CHF 4-hour chart

Trend: bearish