Back

9 Jul 2019

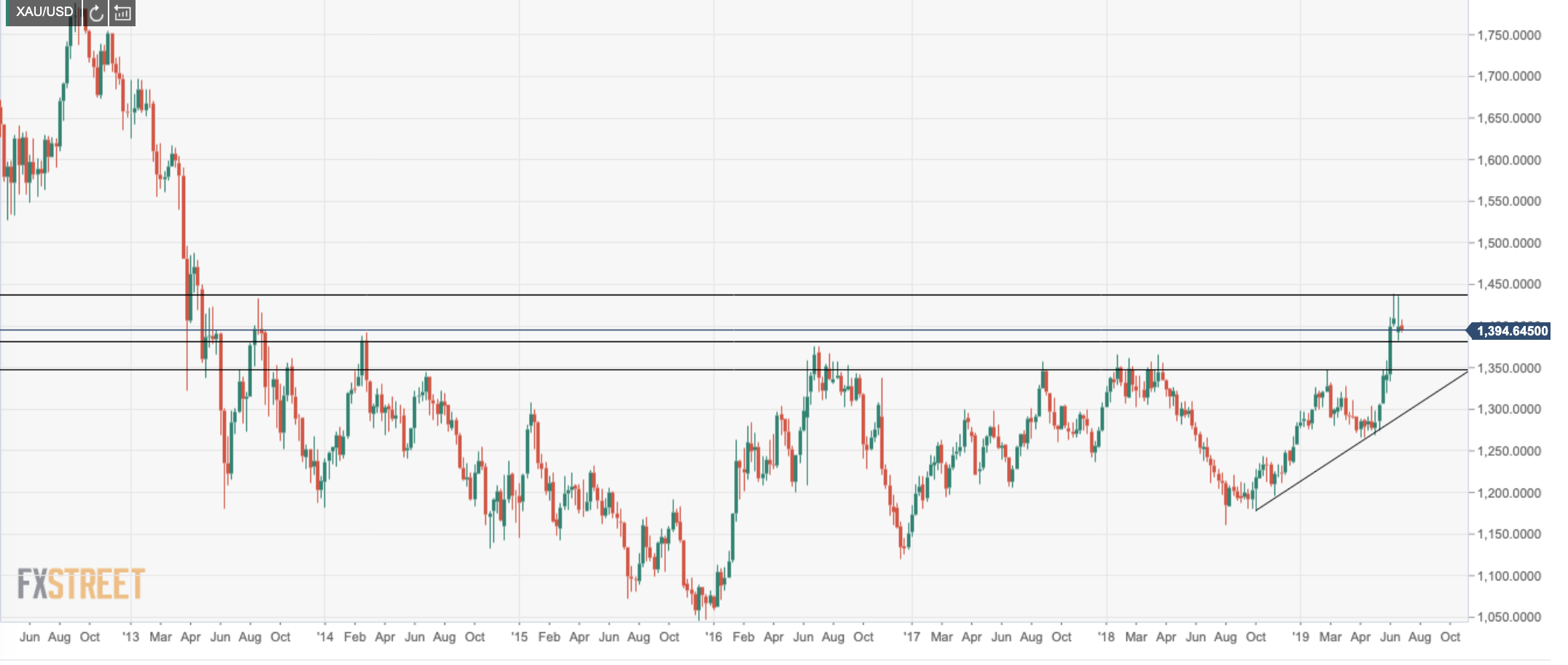

Gold technical analysis: Bears aim for a break below 20-DMA

Gold has been on the backfoot due to recent supportive data for the Dollar which has reduced expectations of an aggressive interest rate cut from the Federal Reserve. However, a quarter-point reduction is still priced in and all eyes will now be on the CPI, the FOMC Minutes and Fed's Powell's two-day testimony. Gold prices, on a technical basis, are on the way down and the 20-day moving average at 1384 comes ahead of 1375. Further out on the downside, bears are looking for a 50% retracement of the April swing lows to late June swing highs around 1352. In a bullish scenario, 1410, then 1440 are key resistances for a continuation to the May 2012 lows at 1527.

Weekly chart

Gold levels