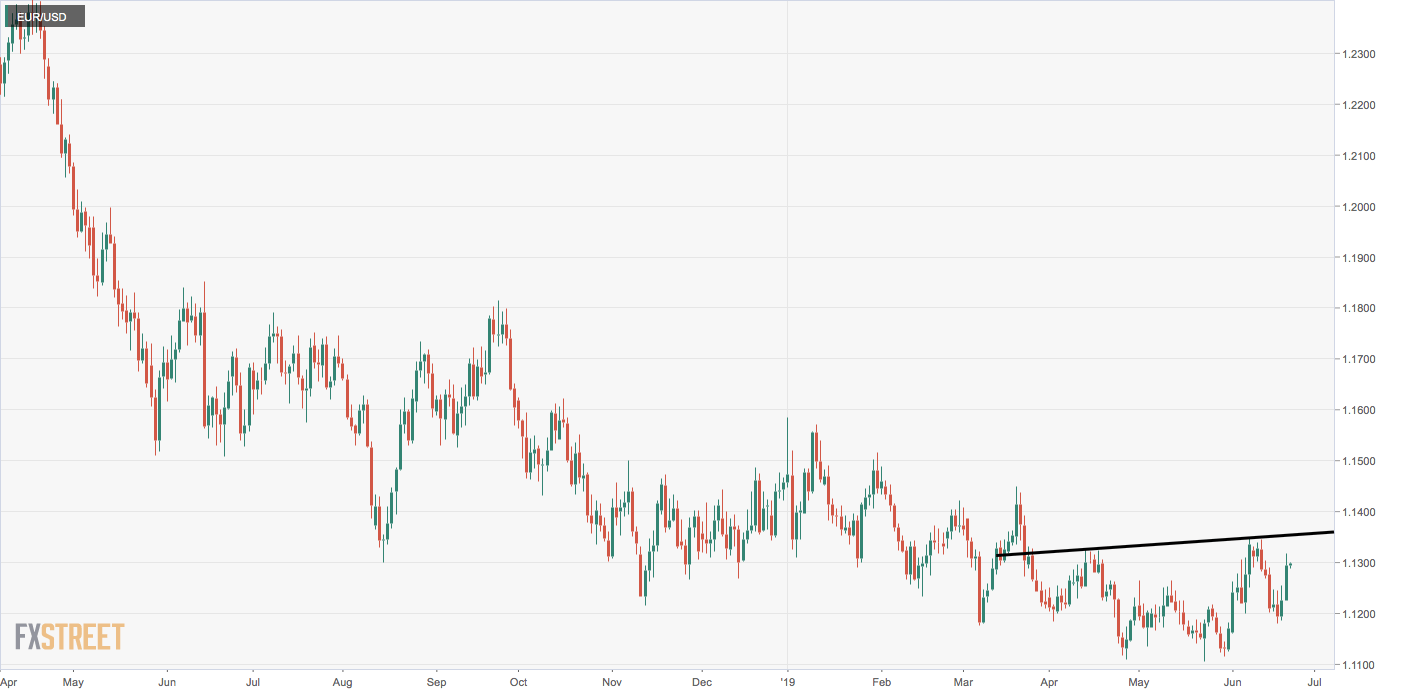

EUR/USD technical analysis: Forming inverse head-and-shoulders, breakout is still 60 pips away

- EUR/USD is creating a major bullish reversal pattern on the daily chart.

- A close above 1.1354 would confirm breakout.

EUR/USD’s daily chart shows the common currency is forming an inverse head-and-shoulders pattern with the neckline resistance, currently at 1.1354.

A daily close above 1.1354 would confirm an inverse head-and-shoulders breakout or a bearish-to-bullish trend change. So, with the spot currently trading at 1.1295, it seems safe to say that the bullish breakout is still 60 pips away.

The breakout, however, may remain elusive or could be short-lived, as markets are fully priced for a Federal Reserve rate cut in July. Also, another rate cut before the year-end seems to have been priced in.

As a result, the US dollar may recover lost ground next week, capping upside in EUR/USD.

It is worth noting that even if the Fed cuts rates three times this year, the US dollar would still retain its position a high-yielding major currency.

Daily chart

Trend: Bullish above 1.1354

Pivot levels