Back

14 Sep 2018

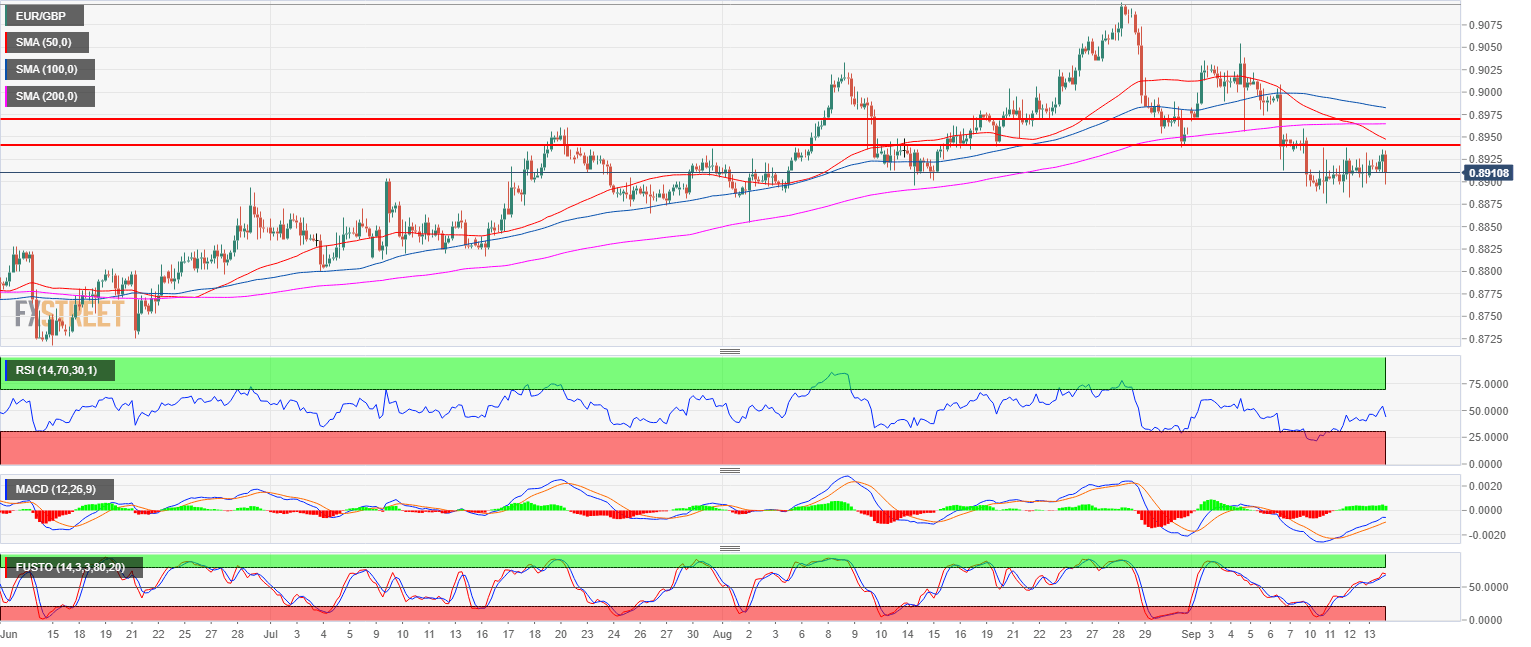

EUR/GBP Technical Analysis: Sticking to the 0.8900 level

- EUR/GBP main bull trend is currently on hold as bulls are supporting the market near the 0.8900 figure.

- EUR/GBP is consolidating the recent losses below its 50, 100 and 200-period simple moving averages which is quite bearish, however, the RSI, MACD and Stochastics indicators are trending upward. Both bears and bulls have a valid case and a breakout in either direction will confirm the directional bias for the coming sessions.

- However, bulls have the longer-term trend on their side and buyers might step in one more time in order to try to revive the uptrend.

EUR/GBP 4-hour chart

Spot rate: 0.8910

Relative change: -0.10%

High: 0.8935

Low: 0.8896

Main Trend: Bullish

Resistance 1: 0.8940 August 14 high

Resistance 2: 0.8974 September 6 low

Resistance 3: 0.9000 figure

Support 1: 0.8896 August 14 swing low

Support 2: 0.8876 September 11 low

Support 3: 0.8840 supply level