Back

13 Jul 2018

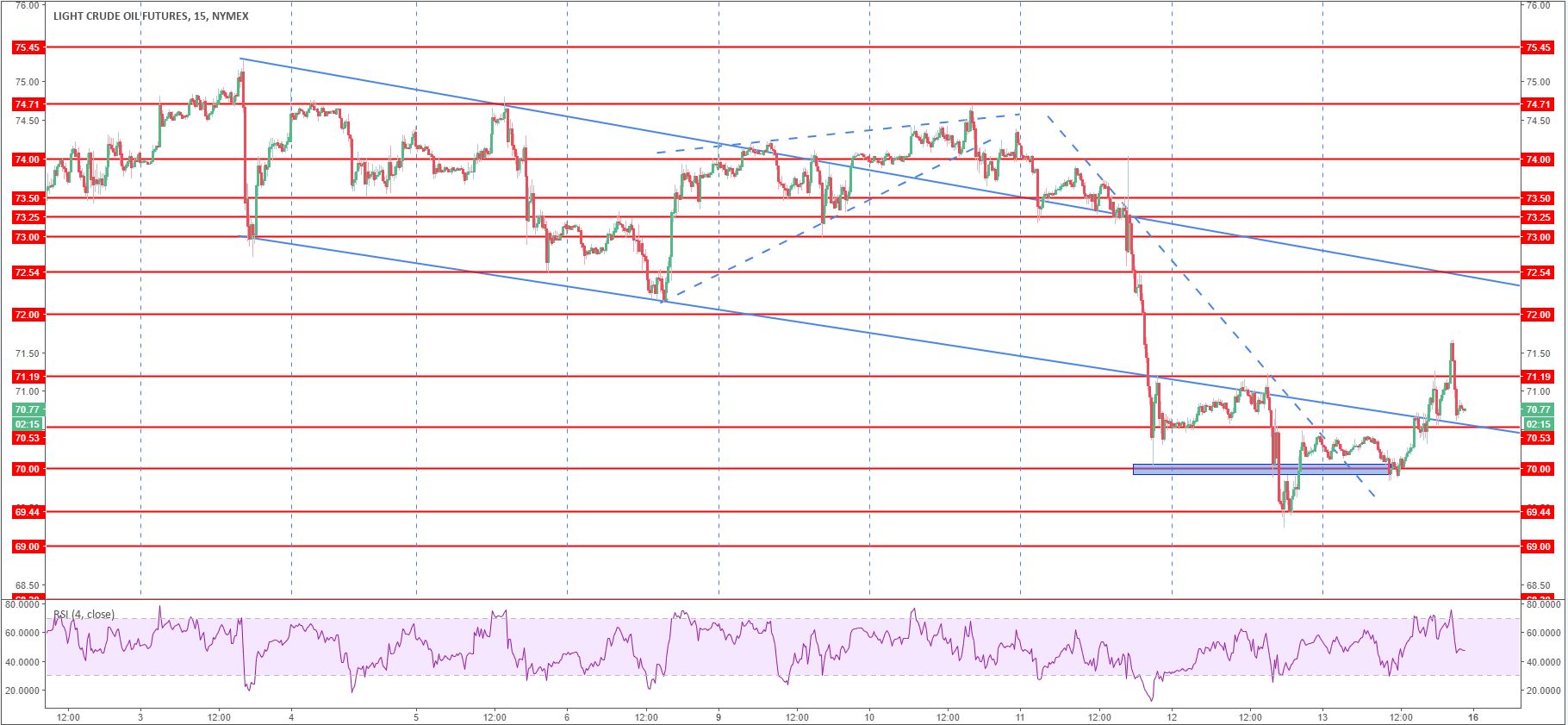

Crude Oil WTI Technical Analysis: Bull correction might be over

- Crude oil rose above 71.19 May 23 low then dropped about $1 to now trade below $71.00 a barrel.

- The bull breakout attempt above 71.00 was met with quite strong selling pressure.

- If bulls are not quick in resuming the up move, the bears might take over again and try to drive the market below the 70.00 figure next week.

Crude oil WTI 15-minute chart

Spot rate: 70.66

Relative change: 0.67%

High: 71.20

Low: 69.21

Trend: Bearish

Resistance 1: 71.19 May 23 low

Resistance 2: 72.25 last week’s low

Resistance 3: 72.83 June 27 swing high

Resistance 4: 72.53 July 5 low

Resistance 5: 73.00 figure

Support 1: 70.53 May 24 low

Support 2: 70.00 figure

Support 3: 69.44 June 25 high

Support 4: 69.00 figure

Support 5: 68.30 demand level