AUD/NZD back into familiar territory after bears failure at 1.0650

- RBNZ rate decision is scheduled on Wednesday at 20.00 GMT.

- The AUD/NZD regains the range as AUD bears failed to trigger a breakout.

The AUD/NZD is currently trading at around 1.0670 up 0.38% on Tuesday so far as the pair bounced back off the 1.0650 level earlier in the Asian session.

Coming up next is the RBNZ rate statement, scheduled on Wednesday at 20.00 GMT with the central bank widely expected to leave rates unchanged.

Earlier in the day, the Reserve Bank of Australia’s minutes offered little new information: “GDP growth is expected to exceed potential growth over 2018, further progress on jobless rate, and CPI to likely be gradual. Yet, household spending and wage growth outlook are still uncertain, warranting" careful monitoring"

According to analysts at Nomura, they think that the labor market is on the right path. They, however, have an interesting stance on monetary policy: “Aussie Treasurer Morrison, who doesn’t set interest rates off course, has just publicly stated that the RBA is unlikely to follow the US Fed in tightening policy. I agree: the RBA is far too late to this global party, and by the time they are finally ready to hit that rate-hike dance-floor and shake their OCR thang, everyone else will be leaving.”

In New-Zealand the Global Dairy trade came in at -1.2%. “A solid dairy auction (GDT-TWI -1.2%; WMP 0.1%), which will support underlying farmer earnings despite a difficult production year.” according to ANZ.

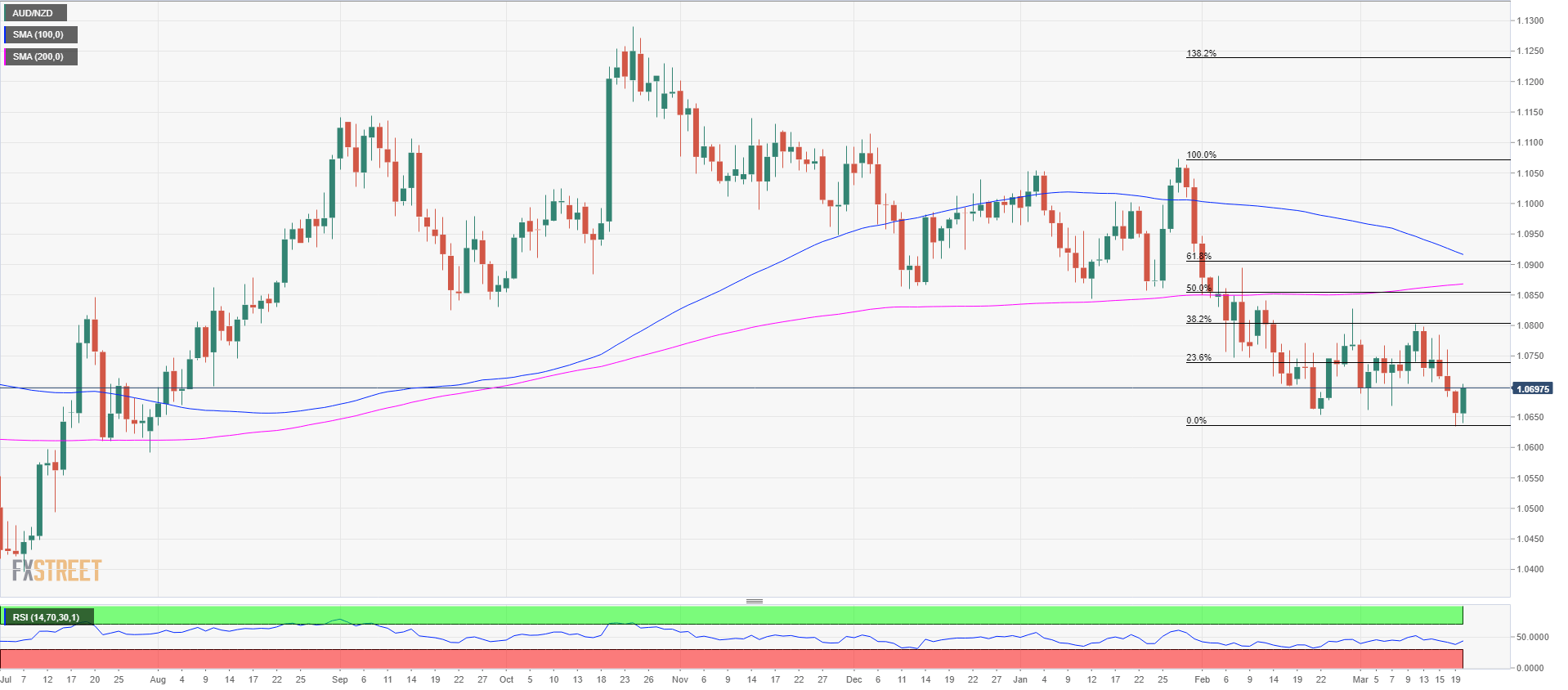

AUD/NZD daily chart

After a bear attack at the 1.0650 level, the bulls took the upper and managed to bring the AUD/NZD cross back into the trading range with the price now trading above Monday’s highs. By doing so, the bulls are preventing the bears to create a trend, at least momentarily. Support is the infamous 1.0650 level which has been holding the price for the last month. If this level is broken to the downside and the bears manage to get a daily close below it then the 1.0600 figure should come into play as the next support. Resistance is seen close to the current level price (1.0700 figure) and then 1.0750 close to the 23.6% Fibonacci retracement from the January-March down move.