EUR/SEK tumbles to lows post-data, near 10.10

- SEK appreciates further following housing, CPI data.

- The cross drops to test daily lows in the 10.15 region.

- SWE CPI rose in line with expectations 1.6% YoY in February.

The Swedish Krona is trading on a firm note on Wednesday and is dragging EUR/SEK to fresh daily lows in the 10.15 neighbourhood in the wake of inflation figures and key data from the domestic housing sector.

EUR/SEK offered on data

The cross dropped to test session lows in the 10.15 area after inflation figures tracked in the Scandinavian economy matched prior surveys for the month of February.

In fact, the CPI rose at an annualized 1.6% and 0.7% inter-month. Furthermore CPIF (CPI at constant interest rate) gained 1.7% over the last twelve months and 0.7% on a monthly basis.

The rise in the CPI was due to higher prices from clothing, package holidays, transport services and energy.

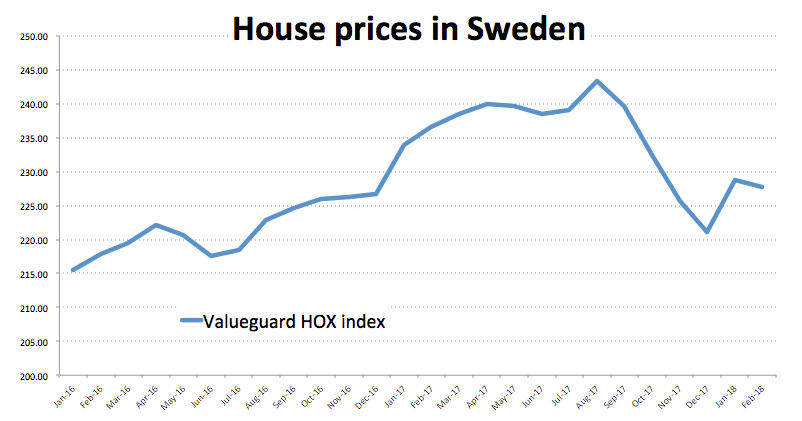

Furthermore, key house prices tracked by the HOX index from Valueguard showed prices in Sweden retreated 3.7% YoY and advanced 0.9% on the three months to February.

In the wake of the data releases, the cross is reverting two consecutive daily advances, although strong support remains around 10.13 for the time being. It is worth mentioning that SEK remains under pressure amidst a dovish stance from the Riksbank and heightened concerns over inflation, house prices and household debt levels.

EUR/SEK levels to consider

As of writing the cross is losing 0.27% at 10.1524 and a breach of 10.1350 (high Mar.13) would expose 10.0728 (21-day sma) and then 10.0561 (38.2% Fibo of 2018 up move). On the upside, the next resistance lines up at 10.1865 (high Mar.9) seconded by 10.2503 (2018 high Mar.7) and finally 10.2606 (monthly high Feb.2010).