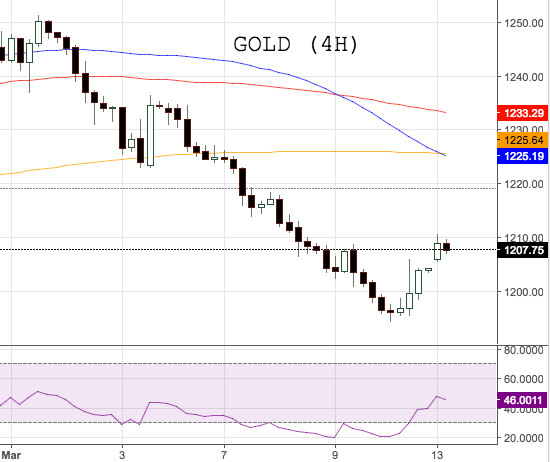

Gold firmer near $1,210, Fed on sight

The troy ounce of the precious metal has regained the critical $1,200 handle and above on Monday.

Gold focus on FOMC meeting

Bullion has managed to leave behind Friday’s multi-week lows in sub-$1,200 levels, as the persistent and renewed selling interest around the greenback has given extra legs to the USD-denominated universe.

The upside momentum in the yellow metal will remain under scrutiny later in the week, as the FOMC is expected to hike rates at its meeting on Wednesday. Currently, and according to Reuters’s Fedwatch, the probability of a 25 bp rate hike is nearly 92%, based on Fed Funds futures prices.

In addition, and from the political side, elections in the Netherlands this week and in France in late April will surely add extra volatility to the metal.

Gold key levels

As of writing Gold is gaining 0.55% at $1,207.95 and a breakout of $1,212.20 (high Mar.8) would expose $1,225.40 (high Mar.7) and then $1,230.25 (23.6% Fibo of the December-February up move). On the other hand, the next support aligns at $1,196.20 (low Mar.10) followed by $1,185.60 (low Jan.26) and finally $1,177.07 (61.8% Fibo of the December-February up move).