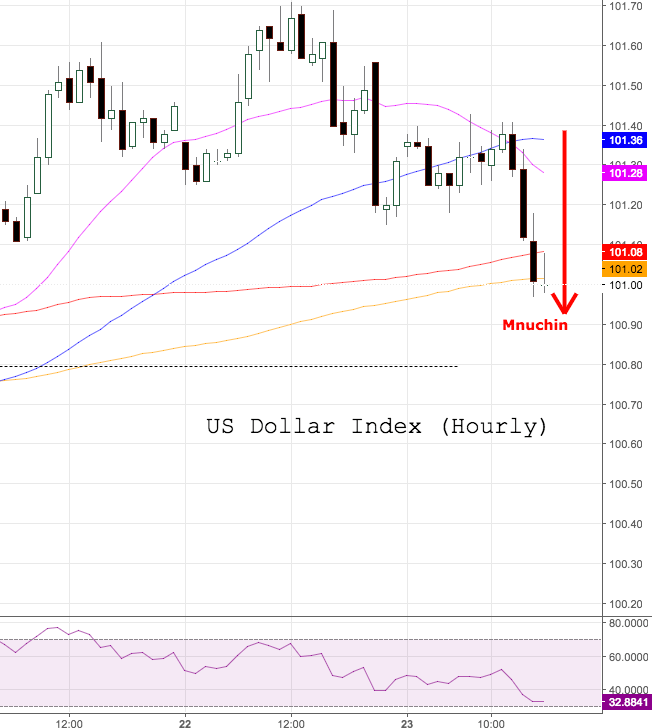

US Dollar plummets to 101.00, 3-day lows

The US Dollar Index – which tracks the buck vs. its main competitors – has accelerated its downside on Wednesday, currently hovering over the 101.00 neighbourhood.

US Dollar offered on Mnuchin, data

The index faced increasing selling pressure after US Treasury Secretary S.Mnuchin said earlier today that the implementation of new policies will have a limited impact this year, while the absolute level of US debt remains a concern.

Earlier at his interview on CNBC, Mnuchin disappointed market expectations after he failed to unveil further details on the ‘phenomenal’ tax reform promised by President D.Trump last week, although he advocated for this to pass by August.

On the data front, US Initial Claims rose by 244K WoW and the Chicago Fed National Activity Index came at -0.05, both prints missing initial estimates and adding further selling pressure to the buck.

USD has surrendered initial gains and is still suffering the consequences of the FOMC minutes, as expectations of a Fed move at the March meeting continue to diminish, taking a toll on US yields.

US Dollar relevant levels

The index is losing 0.28% at 101.03 and a break below 100.74 (low Feb.20) would open the door to 100.54 (20-day sma) and then 100.40 (low Feb.16). On the flip side, the initial hurdle aligns at 101.72 (high Feb.22) ahead of 101.95 (23.6% Fibo of the November-January up move) and finally 102.96 (low Jan.11