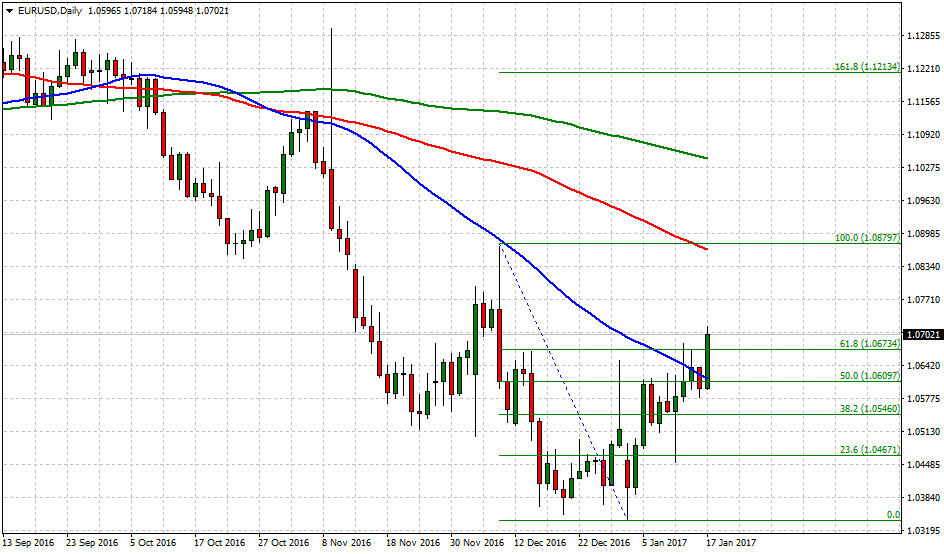

EUR/USD breaks above 50-DMA, targets 1.0860 near 100-DMA

Currently, EUR/USD is trading at 1.0708, up +1.00% on the day, having posted a daily high at 1.0719 and low at 1.0598.

Over the last 6-consecutive weeks, the shared currency has been drilling down short-sellers at different critical levels, at 1.0351 (Dec. 2016 low), later at 1.0339 (Jan. 2017 low) and more recently at 1.0453 (Jan. 11 low). Still, no parity? Furthermore, the EUR/USD has picked up the necessary liquidity from stubborn bears to break above the 50-DMA, clearing the previous bearish scenario to open doors to a new reality towards 1.0860 and above.

What an amazing speech; sadly pound recovery may not last

Barbara Rockefeller, President Rockefeller Treasury Services, notes from today's brave, optimistic and bold speech, "We say the May stance is gutsy, powerful, and exactly the right way to go. EU leaders huffed and puffed about blowing the British house down for having the gall to reject it, and May says the EU will find out the house is made of brick. May's approach may be courageous or fool-hardy, depending on how much weight you put on the various elements, like the financial services "passport."

"PM May is not going to Europe on bended knee and instead chooses to reject the EU before it can reject her. The so-called clean break is not a bluff in a negotiating game—May really doesn't want a "partial membership," presumably because the EU forces that seek punitive retaliation are just too overwhelming. "We do not seek to hold on to bits of membership as we leave." Instead, there has to be an entirely new type of relationship. Not a difference of degree, but of kind. If the price on controlling immigration, including immigration from the EU, is to lose any of the benefits of the single market, so be it."

US CPI preview: Inflation pressure to continue to build in 2017 - Wells Fargo

"European minds are boggling. Europeans pride themselves on being pragmatic and socially minded, meaning they easily rationalize surrendering to superior forces. Not to be sentimental or to overstate the case, but no European country did anything close to the Dunkirk "finest hour" rescue. This is not to say May is Churchill, but she is demonstrating Leadership with a capital L."

EUR/USD Levels to consider

Valeria Bednarik, Chief Analyst at FXStreet, notes, "The EUR/USD pair extended its advance up to 1.0718, with the dollar weighed by comments coming from Donald Trump, as he warned that the greenback is “too strong” for US companies to compete with their Chinese counterparts. Furthermore, the risk-averse sentiment seen at the beginning of the week extended into Tuesday, with Asian share markets plummeting and European ones opening sharply lower, and safe-haven assets extending their latest rally. In the data front, Germany released the January ZEW survey, which continued to improve, although by less than expected, with the index up to 16.6 from previous 13.8. For the whole region, the sentiment also improved, with the survey reaching 23.2, above previous 18.1, but below the 24.2 expected. In the US, the New York Manufacturing index for January came in at 6.5, down from previous 9.0 and the expected 8.5."

In terms of technical levels, upside barriers are aligned up at 1.0868 (100-DMA, red color) and above that at 1.1049 (200-DMA, green color). While supports are aligned at 1.0609 (short-term 50.0% Fib), 1.0546 (short-term 38.2% Fib) and below that at 1.0467 (short-term 23.6% Fib).